Skip to content

Risk and Collateral

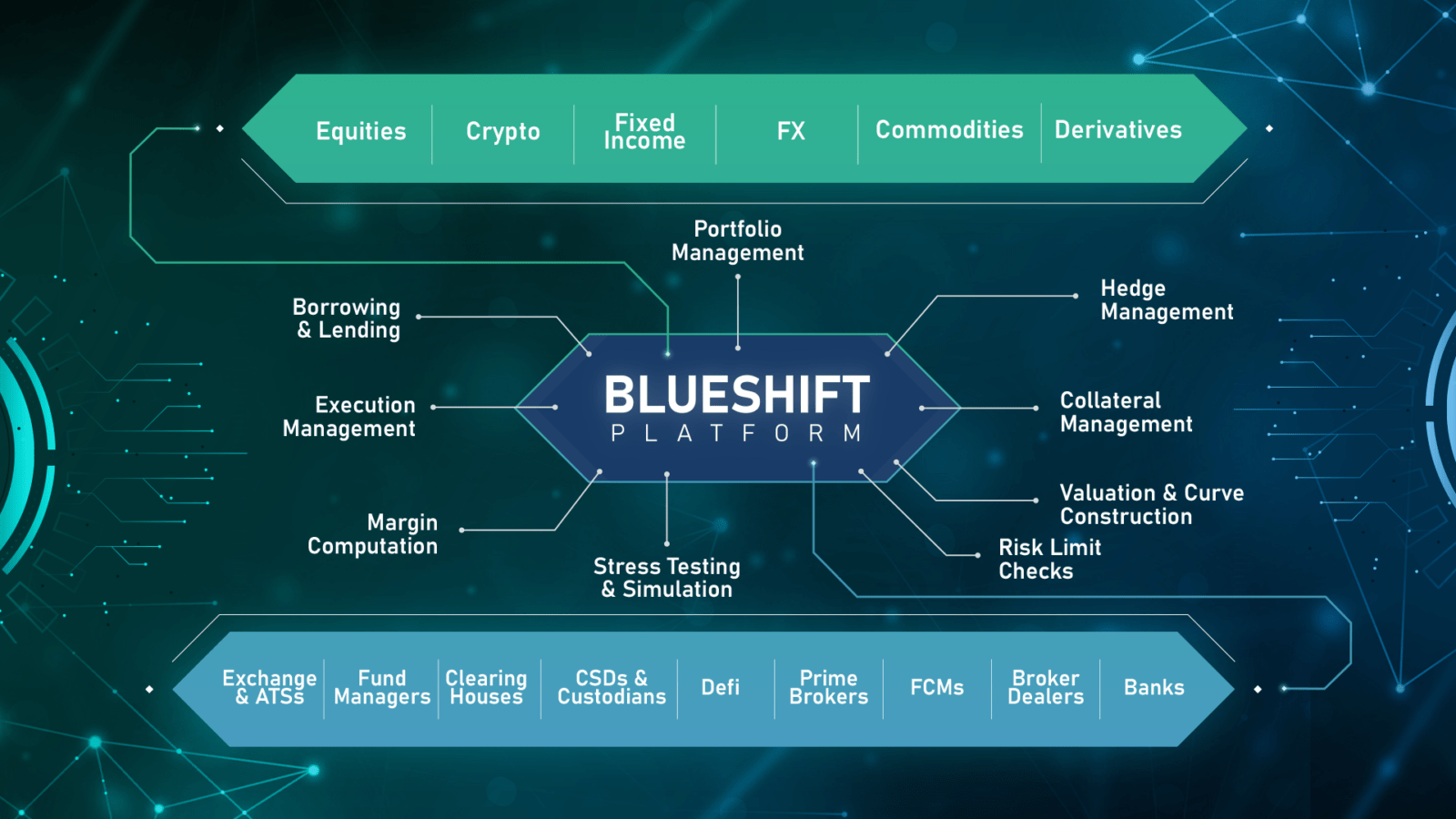

- Real-time risk for multiple asset classes

- Configurable risk models

- Marking to market

- Margin computation with portfolio margining benefits

- Risk and exposure limit checks

- Hedge requirement computation

- Borrowing and lending workflows

- Portfolio analytics

- Collateral management

- Real-time valuation and haircuts

- Concentration and utilization limits

- Optimization using configurable rules

- Simulations

- Stress testing multi-asset portfolios

- Reverse stress testing

- Trade what-if analysis

Market Data

- Real-time data feeds

- Integration with multiple data providers

- Consolidation capabilities

- Permission-based dissemination

- Theoretical pricing and statistics

- Real-time or on-demand valuation

- Volatility surfaces

- Sensitivities

- Index computation

- Curve construction

- Deriving interest rate curves via bootstrapping

- Configurable interpolation and extrapolation

- Historical data *

- Validations and enrichments

- Historical risk factor return simulation and volatility scaling

Clearing & Settlement

- Trade management

- Integration with multiple trade sources

- Real-time trade processing

- Configurable posting rules

- Reconciliation

- Position management

- Configurable position netting rules

- Real-time updates based on trades, settlement feedback, and transfers

- Compliance with portability and segregation rules

- Scheduled workflows

- Corporate actions

- Cash and securities settlement

- Intra-day and end-of-day margin runs

- User management

- Configurable user roles and privileges

- Participant access

- Dual controls

Go to Top